Stock Ownership of Directors and Executive Officers

The following table provides, as of February

28, 2021,29, 2024 the amount of shares of Company Common Stock beneficially owned by each Director, each Named Executive Officer, and by all Directors and executive officers of the Company as a group, and information about the amount of their

other Company equity-based

holdings. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | | | | | | | Shares Beneficially Owned(1) | | Other Equity-Based Holdings(2) | | Total(3) |

| (#) | | (#) | | (#) |

| | | | | | |

George Campbell, Jr. | | | | | | | | | | 33,575 | | | | | 13,911 | | | | | 47,486 | |

| | | | | | |

Ellen V. Futter | | | | | | | | | | 31,255 | | | | | 7,724 | | | | | 38,979 | |

| | | | | | |

John F. Killian | | | | | | | | | | 18,019 | | | | | 11,323 | | | | | 29,342 | |

| | | | | | |

Karol V. Mason | | | | | | | | | | 138 | | | | | 554 | | | | | 692 | |

| | | | | | |

John McAvoy(4) | | | | | | | | | | 10,998 | | | | | 129,838 | | | | | 140,836 | |

| | | | | | |

Dwight A. McBride | | | | | | | | | | 692 | | | | | — | | | | | 692 | |

| | | | | | |

William J. Mulrow | | | | | | | | | | — | | | | | 7,063 | | | | | 7,063 | |

| | | | | | |

Armando J. Olivera | | | | | | | | | | 16,687 | | | | | — | | | | | 16,687 | |

| | | | | | |

Michael W. Ranger | | | | | | | | | | 65,556 | | | | | — | | | | | 65,556 | |

| | | | | | |

Linda S. Sanford | | | | | | | | | | 15,857 | | | | | — | | | | | 15,857 | |

| | | | | | |

Deirdre Stanley | | | | | | | | | | 8,690 | | | | | 3,107 | | | | | 11,797 | |

| | | | | | |

L. Frederick Sutherland | | | | | | | | | | 62,077 | | | | | 7,597 | | | | | 69,674 | |

| | | | | | |

Timothy P. Cawley | | | | | | | | | | 3,860 | | | | | 12,499 | | | | | 16,359 | |

| | | | | | |

Robert Hoglund | | | | | | | | | | 12,480 | | | | | 30,000 | | | | | 42,480 | |

| | | | | | |

Deneen L. Donnley | | | | | | | | | | 640 | | | | | — | | | | | 640 | |

| | | | | | |

Robert Sanchez | | | | | | | | | | 3,668 | | | | | 3,369 | | | | | 7,037 | |

| | | | | | |

Mark Noyes | | | | | | | | | | 18 | | | | | 8,242 | | | | | 8,260 | |

| | | | | | |

| Directors and Executive Officers as a group, including the above-named persons (26 persons) | | | | | | | | | | 307,154 | | | | | 289,458 | | | | | 596,612 | |

Footnotes:

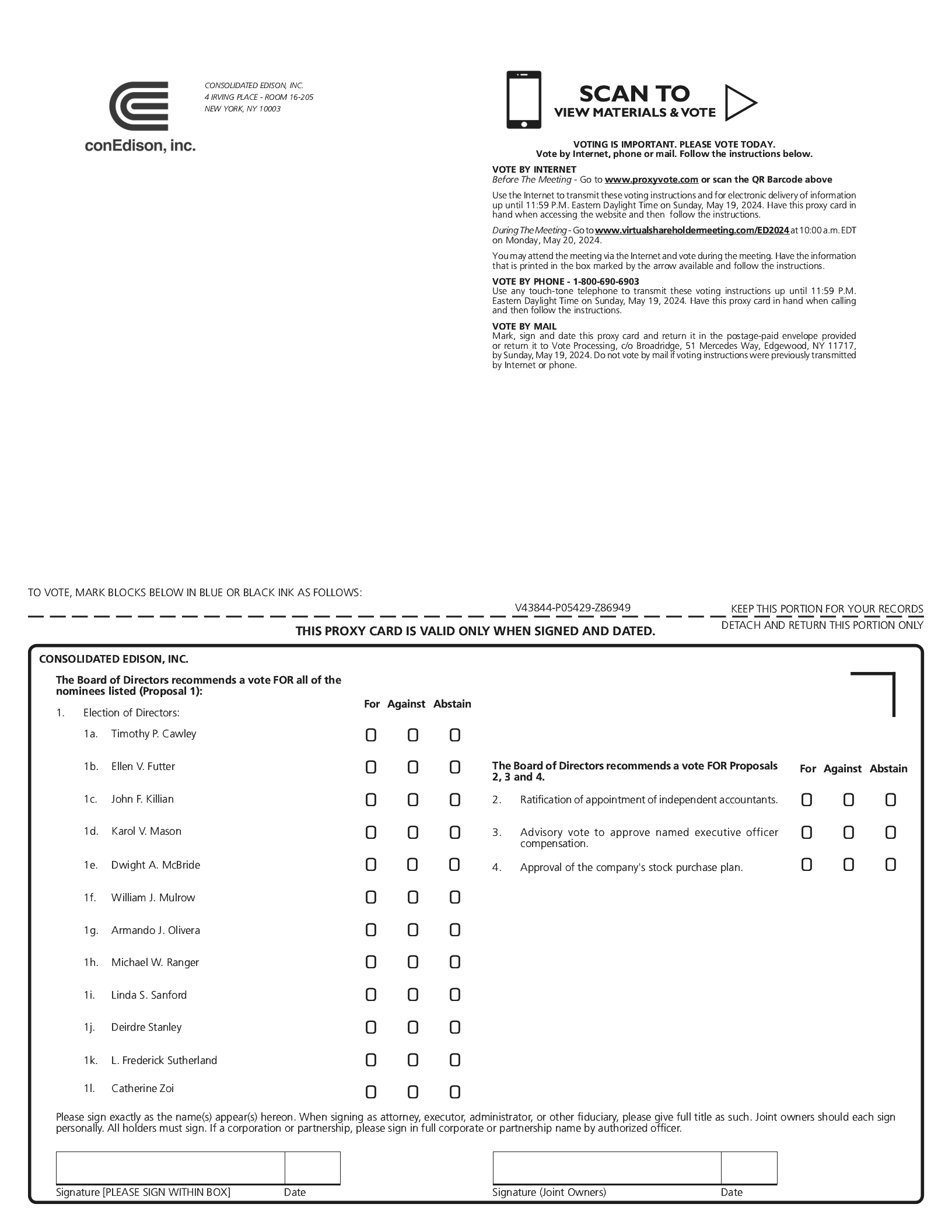

holdings in the Company’s stock plans.Timothy P. Cawley | | | 6,335 | | | 79,870 | | | 86,205 |

Ellen V. Futter | | | 38,193 | | | 6,000 | | | 44,193 |

John F. Killian | | | 25,687 | | | 12,400 | | | 38,087 |

Karol V. Mason | | | — | | | 6,328 | | | 6,328 |

Dwight A. McBride | | | 5,906 | | | — | | | 5,906 |

William J. Mulrow | | | 4,676 | | | 9,923 | | | 14,599 |

Armando J. Olivera | | | 24,103 | | | — | | | 24,103 |

Michael W. Ranger | | | 85,277 | | | — | | | 85,277 |

Linda S. Sanford | | | 22,960 | | | — | | | 22,960 |

Deirdre Stanley | | | 20,105 | | | 3,465 | | | 23,570 |

L. Frederick Sutherland | | | 74,307 | | | 8,470 | | | 82,777 |

Catherine Zoi | | | 431 | | | — | | | 431 |

Robert Hoglund | | | 14,858 | | | 30,000 | | | 44,858 |

Matthew Ketschke | | | 690 | | | 21,448 | | | 22,138 |

Deneen L. Donnley | | | 1,796 | | | 17,324 | | | 19,120 |

Robert Sanchez | | | 5,242 | | | 8,791 | | | 14,033 |

Mark Noyes(4) | | | — | | | 28,794 | | | 28,794 |

Directors and Executive Officers as a group, including the above-named persons (23 persons) | | | 333,724 | | | 244,015 | | | 577,739 |

Footnotes:

(1)

| The number of shares shown includes shares of Company Common Stock that are individually or jointly owned, as well as shares over which the individual has sole or shared investment or sole or shared voting power. The number of shares shown also includes vested stock units, as to which the individual may obtain investment or voting power within 60 days following separation from service: Dr. Campbell—29,416; Ms. Futter—28,909;35,847; Mr. Killian—18,019;5,547; Ms. Mason—138;0; Dr. McBride—5,906 Mr. McAvoy—878; Dr. McBride—692;Mulrow—1,471; Mr. Mulrow—0;Olivera—23,603; Mr. Olivera—16,187;Ranger—85,277; Ms. Sanford—20,560; Ms. Stanley—20,105; Mr. Ranger—65,556;Sutherland—70,307; Ms. Sanford—13,456; Ms. Stanley—8,690; Mr. Sutherland—58,077; Mr. Cawley—0; Mr. Hoglund—0; Ms. Donnley—0; Mr. Sanchez—0; Mr. Noyes—0;Zoi—431 and directors and executive officers as a group—240,018.301,133. |

(2)

| Represents vested stock units, as to which the individual may not, within 60 days after February 28, 2021,29, 2024, obtain investment or voting power. |

(3)

| As of February 28, 2021,29, 2024, ownership was, in each case, less than 1% of the outstanding 342,489,578 shares. 345,567,126 shares outstanding. |

(4)

| Based on Mr. McAvoy retiredNoyes’ holdings as President and Chief Executive Officer of his termination of employment (March 1, 2023) pursuant to the Company and Chief Executive Officer of Con Edison of New York effective December 28, 2020. He became a non-employee Director effective December 29, 2020 and the Non-executive Chairman of the Board and Con Edison of New York. Company’s records. |